Full Guide to Managing Family Finances – Chapter 9

You feel ready to buy your first home. Fantastic! What are the practical things you need to know? Let’s start with the basics.

To buy a property, most of us need a mortgage. A mortgage is a type of loan, a fixed capital sum, lent by a bank or building society in order to buy land, a house or some other type of real estate. Monthly repayments on a mortgage include the cost of interest, and if these repayments are not met, then a person may lose their home. This is because the bank or building society has the right to sell that property if it is the only way the loan will be repaid. That’s why a mortgage is sometimes called a ‘secured’ loan, in that it is secured by a physical asset, the property itself. It serves as the security the bank enjoys.

Can I get a mortgage?

Before you rush into the bank, do some basic research and calculations. The questions to ask yourself are:

- How much do you have in savings?

- How much do you earn in a year? This includes self-employment, wages or salaries, and any other income other than the interest on those precious savings.

- If you are dependent on your job for your income, how stable is it? If you are in self-employment, do your earnings vary significantly?

- Are you buying a home with a partner, friend, or family member?

- Do you have any debts with credit cards or other loans? How much is this in total?

- What is your credit rating or score?

When you are certain about these things, you can speak with confidence with a bank or building society representative, or mortgage broker. They will be thinking about your ability to make monthly repayments on a mortgage, and the answers to all these questions make a difference.

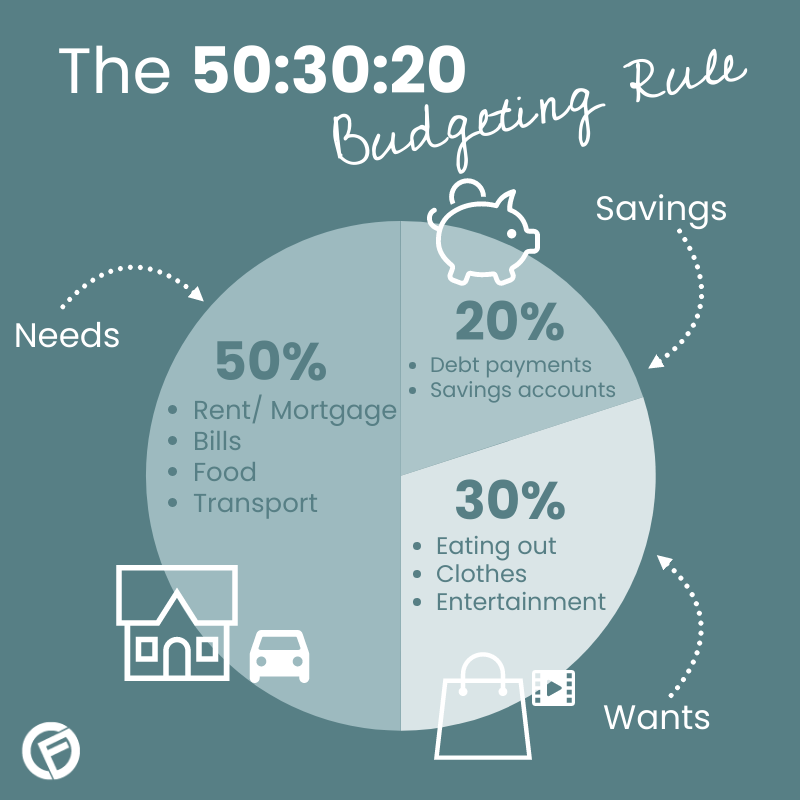

Remember, you will have other expenses, and it is a good idea to consider even the smallest costs so that you don’t resort to short term loans. The mortgage you will be permitted to borrow will depend on your overall financial health and stability.

Begin with an agreement in principle

Many mortgage calculators on the internet tell you how much mortgage lenders will be willing to lend you. They will also tell you how much the monthly repayments will be and for how long.

Get an Agreement in Principle (AiP). Approach a mortgage company or bank and get an AiP, a realistic estimate of how much the bank or mortgage lender will lend to you. Take note that getting an AiP is not a guarantee that the mortgage lender will lend you a mortgage. However, it is a realistic expectation.

Add the value of the mortgage to the total of your savings, and that is a guide to the sale price you can be looking at when considering a property to buy.

How to search for a suitable property

Start your research. Most people searching for property will look online at major property websites like Zoopla and Rightmove. These sites make it easy to get a sense of asking prices, and your searches can be easily refined by location and number of bedrooms.

There are other ways to search for and find a suitable property:

- Look around! Take a train or bus to different areas you’re interested in, and spend some time walking around them. Nothing gives you a sense of a place like being there in person.

- Ask the question. If there is a property you really love, and it is unlike any other, why not drop a note through the door, introducing yourself and saying you’re interested in buying it or something like it. You never know.

- Go to viewings. Online photographs simply can’t convey everything about a property or place, and your gut feelings when you see it will help refine your decision-making. Viewings are easy to arrange through estate agents or directly with the owners.

-

Check Land Registry records. These tell you what a property actually sold for, and when sales transactions

happened. If a property has been sold every three or four years, that could be a real red flag. If the current asking

price advertised is excessively above what that property sold for only a few years before, or well above what other similar

properties have actually sold for recently, the owners may not be realistic about the value of their home.

This all serves as great research, and it will give you a better sense of what is most important to you. So what matters most? Here are some factors which many prospective home-owners are thinking about: - Travel links. Is it important to be close to the train station? How long will it take you to walk or drive there?

- Commuting time. How long does it take to get to the children’s school, a shopping centre, GP, gym, or supermarket? How far are you from the workplace?

- Availability of outdoor or garden space. If you don’t have a garden, can you easily walk to a park? Are there attractive communal spaces?

- Service charges. For some city apartments, annual service charges are very high, and they are not negotiable. Are they affordable for you?

-

Refurbishment, repair and maintenance costs. If it is an older property, it is likely to need some work

to keep it looking as lovely as it should, or keep essentials like the plumbing in good working order. Will you be dependent

on hired labour and expertise for this? And what might these bills come to?

If you have a car, is there a place to park? What about storage space inside? All of these things help you think about the property and how well it suits your lifestyle. There is usually some compromise involved – you can’t have everything you want.

How to make an offer

If the property is managed by an estate agent, then communicate your feelings about a property and any offer on it to them. It is in their interests that the process of making an offer and having it accepted is a smooth and happy one, because their earnings and commission is earned on the sale price of the property.

What offer should I make? Many people put an offer in a small percentage below the asking price, expecting it to be negotiated. Bear in mind that the estate agents and owners are likely to get other offers, too, and have every reason to accept a higher one. ‘Lowballing’ also creates a poor impression – it suggests the person making the offer is not serious, or doesn’t respect the time of the people involved.

What if my offer is turned down? It happens.Try not to be disheartened. It is easy to be excited or emotional about a house or flat – home is where the heart is, after all! Take a few hours or days to recover from it, then resume your search.

My offer has been accepted! Congratulations. But it is not over yet. That is a verbal agreement, and in England an offer like this on a property isn’t binding. There follows a legal process, so it is time to get a solicitor or conveyancer (sometimes called a conveyancing solicitor).

They will begin a series of checks on the property, take care of the deposits, and handle the exchange of contracts. Only once contracts have been exchanged (several weeks or months later), is the property definitely yours. What follows is known as the completion of the sale.

As soon as possible, go back to your bank and arrange a real mortgage application. Think about whether to opt for a fixed or variable interest rate, and how long the mortgage repayment term will be. These factors affect your monthly payments. Your bank or building society will also want to arrange a building inspection, and may charge other fees for processing the application. All this costs a little bit of money – so be sure to have room in your budget for that.

Take control of the paperwork! Yes, there is a lot of paperwork involved when buying a house. Make sure you keep on top of it and keep it all safe.

Other expenses when buying and owning a home

When buying your first home, have enough room in your budget for:

- Solicitor’s fees

- Moving costs – van hire, and one or more helpers!

- Stamp duty – payable if the property is more than £125,000. Your solicitor will make this calculation and include it in a list of fees

- House insurance – usually a requirement from the lender before they agree to a mortgage

- Energy and other bills

- Ill health and death insurance so that a spouse or child will not lose their home.

How much Is a deposit on a house?

| Deposit | |

|---|---|

| 5% | Some mortgage lenders will lend 95% if you have a 5% deposit – however they are hard to find and the terms may be harsh. |

| 6%-19% | You are likely to get a mortgage, however, interest rates will be high. |

| 20% | This is the ideal mortgage deposit that will give you attractive mortgage deals. |

We think you’ll enjoy these articles too:

Do You Need Financial Help To Build Homes? Try The Home Building Fund

Do you need Financial Help for Moving House?

Chapter 8:

Will a student loan affect my future?

Chapter 10:

Divorce settlement: What am I entitled to?