In this article, we present several different budgeting books that can have a huge impact on your financial life. Choose a book and read it well. Reading a budgeting book will all change the way you look at money and help you budget your life better.

Why are Budgeting Books Important?

Managing your finances isn’t necessarily something that comes naturally to everyone. In fact, most people have to learn how to do it. People often lament that schools fail to teach children the life skills they need to survive as adults. They might learn how to cook or get some lessons in sex education. However, financial education is often missing from students’ schedules. They don’t learn how to create a household budget, handle their taxes, or take out a loan. Many people have their parents to teach them these things. Others seek out education on important subjects on their own initiative. However, many people don’t make the effort to learn these skills.

If you need to manage your money better, there’s no shortage of resources to help you. You can find information online, and there are many useful budgeting books for in-depth information. You don’t even need to buy anything, as some of the best budgeting books will be available at your local library. There is a lot you can learn a lot from reading someone’s detailed take on how to view your personal finances. Without essential money management skills, you can end up in dire financial straits. You might end up turning to high-cost, short-term credit to get you out of a hole. Furnishing yourself with these valuable skills will help you avoid that. Try some of these excellent budgeting books to start managing your finances better.

- The Only Budgeting Book You’ll Ever Need – Tere Stouffer

- Rich Dad Poor Dad – Robert T. Kiyosaki

- Frugal Stuff That Works – Elaine Colliar/The Matrixettes

- The Minimalist Budget – Simeon Lindstrom

- Back to Black: How to become debt free and stay that way – Michael J MacMahon

- FT Guide to Saving and Investing for Retirement – Yoram Lustig

- Superscrimpers: Live Life for Half the Price – Eithne Farry

- The Financial Wellbeing Book – Chris Budd

- How to Worry Less About Money – John Armstrong

According to the title of this book, this list could end here. While it might not be the only book you will need for budgeting; it’s an excellent place to start. If you’re a beginner at budgeting, this book will help you create a budget and a financial plan. It’s designed not just to help you with your present expenses but to think about the future too. You can set up a budget that allows you to save on your regular costs while saving money for future finances. The book aims to give you realistic advice that anyone can use so that you can stay out of debt. It also has a resource guide, including web tools that you can use to make your budgeting easier.

Rich Dad Poor Dad is subtitled “What the Rich Teach Their Kids.” Although it was first published in 1997, it still has plenty of information relevant to today. The book aims to explore the skills that wealthy parents pass onto their children. Less well-off parents don’t share them or even have themselves. In it, Kiyosaki compares his real father with his best friend’s father, who became his mentor. His real dad or his “poor dad” often struggled financially. His “rich dad” was an entrepreneur who became one of the wealthiest men in Hawaii. The book addresses the fact that you can’t rely on schools to teach people about money. You can learn to look at money from a different perspective, and pass your knowledge to your children.

This book may be short, but it’s packed full of useful tips. It features 50 top tips from readers and authors of the blog Mortgage Free in Three. The tips featured in the book are tried and tested by real people. They have worked for the people who shared them, so you can make them work for you too. It helps you do everything from menu planning to finding discounts. Although it was written by women and for women, it’s useful anyone. It’s currently the number one budgeting book on Amazon.

Do you think your lifestyle is too full of stuff? This book aims to combine budgeting with a minimalist approach to life. It takes a new view of budgeting that involves not just managing money. The approach seeks to consider your emotional, behavioural and even spiritual capital. After all, money doesn’t exist in a vacuum. You have to look at it in perspective with the rest of your life. The focus on minimalism allows you to spend your money wisely by identifying what you need. Rather than trying to live on less than you require or being thrifty, the author argues you should aim to live without excess.

Dealing with debt is one of the financial problems that can cause you all sorts of trouble. If you find yourself struggling to make payments, you might take out short-term credit. However, there is plenty of advice to help you deal with debt, including this book. The book helps you both to address your finances and the stress that dealing with debt can cause. It will help you work out a repayment schedule and track your spending without making life miserable. The author shares his personal experience. He guides you through how to work towards a debt-free life. There’s also a useful resources section to help you find further information and support.

Keeping your finances stable is essential not just for the present day but for the future too. You could be at risk of turning to instant payday loans in the future, especially after retirement. Many people find that their state pension doesn’t go as far as they hoped it would. Taking further steps to save and make investments for retirement is a smart idea. This Financial Times guide will help you plan for retirement so that you can live comfortably. It will help you navigate taxes, ISAs, pensions and making the right investments. No matter how old you are, you can benefit from starting to plan for retirement.

Another money-saving book, this one is full of tips from Channel 4’s Superscrimpers. Being as thrifty as possible has become more popular in recent years. Many people are looking to the past for help. There are many things we can learn from our parents and grandparents that they used to save out of necessity. Whether you’re struggling to pay the bills or you just want some more spending money, this book will help you save and make the most of what you have. It gives you tips on how to enjoy your life cheaply, by finding fashion, home and beauty bargains.

The aim of this book is to help bring you peace of mind concerning your finances. Money can cause you a lot of stress, but being on top of your finances contributes to easing it. This book provides you with a guide to planning daily and long-term finances. The author is an experienced financial adviser. He argues that you have to get to know yourself and your motivations to sort out your finances. Doing so will help you to make the right decisions, set goals and be prepared for a financial emergency.

Many financial and budgeting books focus on helping you manage or make money. This guide helps you to take a healthier approach to your finances, so you don’t worry about them as much. Redefining how you relate to money can make you better at managing it and help you realise what you need. Realising what’s important to you will help you sort out your priorities and avoid spending money in the wrong places.

Tips for Organising your Reading

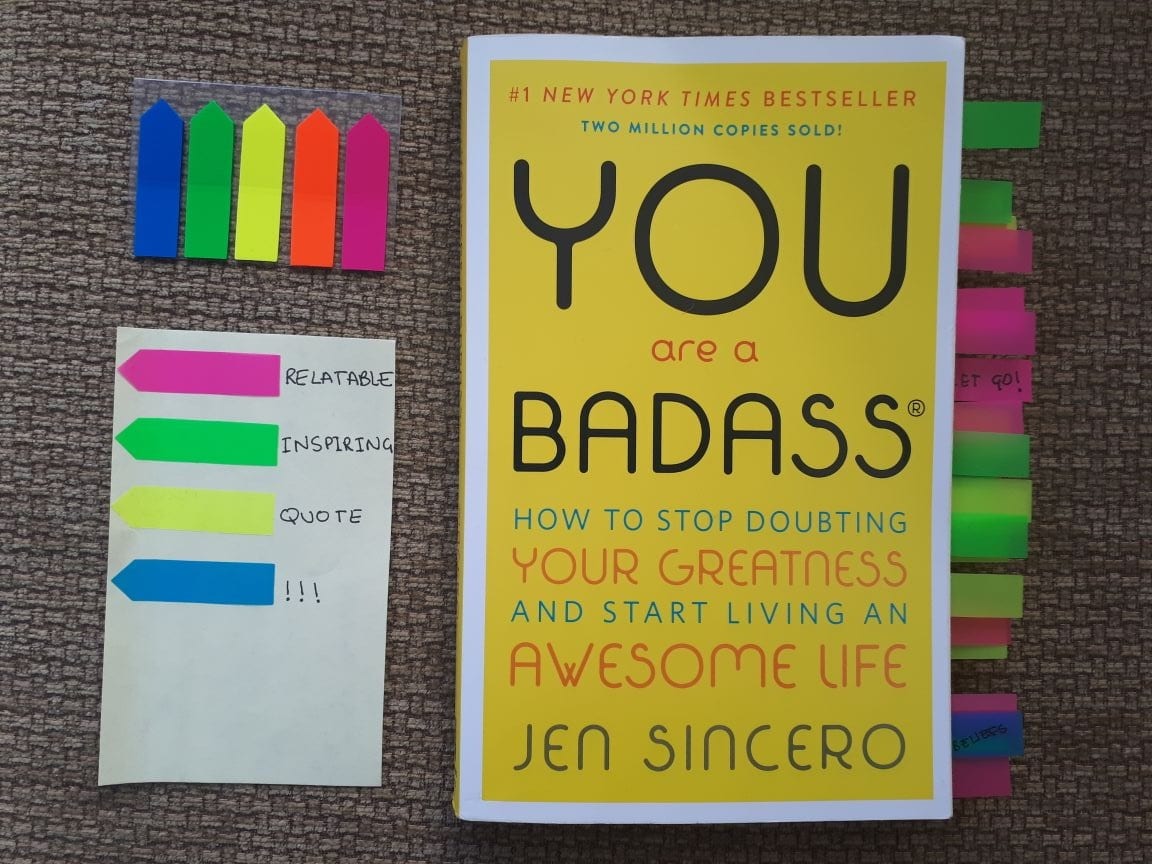

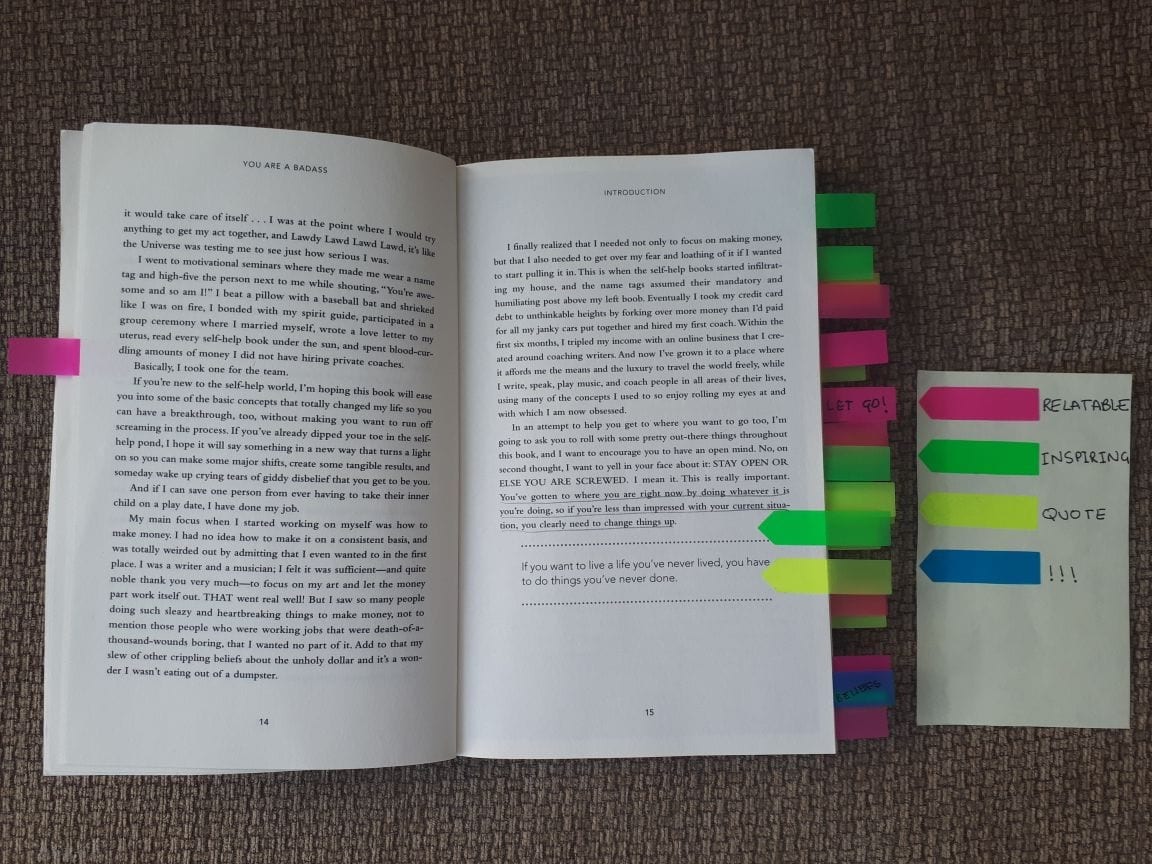

When you’re reading, you will often come across really good tips and advice that make you think ‘Now THAT is what I needed to hear!’ But then, you carry on reading and you come across more amazing advice and inspiration that you forget about the ones you read earlier on! Whereas reading books digitally has helped to solve this issue by allowing highlights etc… if you prefer the old-style hand-in-book feeling, we’ve come up with a great way for you to keep track of all the inspiration you come across! All you’ll need are some page markers and piece of paper and pen for your key:

Conclusion

There are so many helpful budgeting books that will assist you with your financial skills and knowledge. Try one of these to get started and make your money management healthier. You’re far more likely to find yourself short of money towards the end of the month, and take out a fast short term loan to make it, if you don’t have a budget that you stick to. So go on, pick a book that appeals to you, and read!