Full Guide to Managing Family Finances – Chapter 7

It’s never too early to get into the habit of budgeting, and there is no better time to start than being a teenager! In this article, you will learn all about budgeting for teens. Let’s begin!

Budgeting tips for teens

For most of us, pocket money is our first taste of financial responsibility. Mistakes we make at this age can teach us a great deal about how we later cope with our first salary. There are some things that parents can do to make sure their kids develop a healthy attitude to money. Let’s go through them.

Tip #1: Allocate a fixed sum of pocket money – and stick to it

Instead of shelling out whenever your children want something, you need to allocate a regular sum of money. This can be weekly or monthly. Your kids should realise this is how much they’ll get and won’t get any more. This sum should increase as they get older. You should sit down and have a chat with children about the pocket money they receive. Both sides should be clear about what they’re expected to pay for. If necessary, also discuss whether they’re expected to do some chores in return. You should be prepared to compromise during this talk.

As they grow, you need to talk to them in greater detail about budgeting. You also need to trust them more with money. By their teenage years, they should be responsible for most of their spending decisions. Work out together how much their expenses are (for example, for their phone, lunch, bus fares, etc.) and give them this amount.

Tip #2: Don’t bail them out

Treat them like an adult, and they’re more likely to act like one. It’s very important for you to be consistent and not bail them out if they get into trouble. Teenagers have to learn that the ‘Bank of Mum & Dad’ doesn’t possess unending money reserves. In the same way, you keep track of your spending, they should make intelligent choices about their budgeting and spending habits.

Tip #3: Whether you’re prepared to lend your teenage children money is completely up to you

If it’s a one-off purchase, you may give a helping hand. But, you must make sure that they pay the money back. Not necessarily in one lump sum, but gradually over a few months. This will teach them the problem of borrowing in general and credit in particular. It might also be the ideal opportunity to explain how interest works to them. They will learn how much they would have had to give back if you were a financial institution like an online loan company.

Tip #4: Get into the habit of saving

Your child should already have a bank account. If they don’t, now is the time to open an account, letting them be part of the decision-making process. Explain the importance of savings, how different accounts work and the importance of interest on savings. They should decide how accessible they want their savings to be.

Encourage your child to regularly add to this account. Whether it’s pocket money, casual work, or money they receive from family for birthdays and Christmas, they should aim to put at least 10% of this money into their account.

Is there anything that your child would really like? If it is a top-of-the-range piece of technology or new clothing, give them a short-term goal showing how they’ll be able to save up for it in a certain number of weeks. Encourage them to research the market, compare different stores/ online sites and take advantage of sales so they can make the most of their money.

Tip #5: If they’re overspending, get them to write down what they’re spending money on

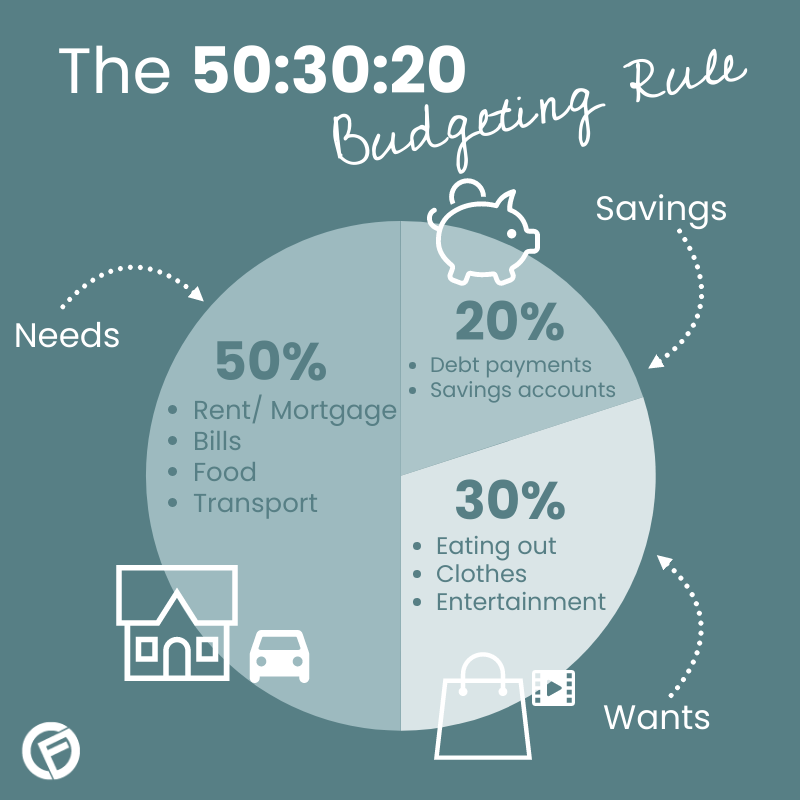

If your teenage child always runs out of money, get them to sit down and write down everything they spent their money on. This will show them more clearly than anything the impact bad spending habits can have on their finances. If they buy a soft drink every day at school, they won’t be able to save up for the brand-name trainers they want. After this, you can show them how to draw up a budget.

Tip #6: Encourage them to work

Once your teenage child has reached their sixteenth birthday, you might decide together that they get a part-time job to add to the pocket money they already receive from you. They can now equate the money they spend with how many hours they worked to earn it. This can completely change their attitude to how they spend.

Ensure that their work doesn’t affect their academic performance and still gives them time for leisure activities. A part-time job shouldn’t have such an impact that it affects their marks or prevents them from playing sports.

Budgeting apps for teens

Gone are the days of piggy banks. Now, there are pocket money apps for kids and teens that let them digitally manage their allowances and savings. These apps make it convenient and teach them essential financial skills for the future.

HyperJar Kids is a pocket money app that comes with a prepaid card. Parents/ Carers get to load their child’s card with a fixed amount every month, and they can also control where and when it gets spent. This app is free.

RoosterMoney offers a range of plans, starting with a basic task tracker and progressing to a prepaid card. They have two free plans: Star Chart for ages three and up, which rewards children with “Stars” for good behaviour instead of money, and Virtual Tracker for children aged five and above, allowing them to track their money and spending. The Rooster Plus plan, costing £14.99 per year, is suitable for all ages and includes goal-setting, chore management, and the ability to create interest rates for encouraging saving. The final plan, Rooster Card, costs £24.99 per year for the first card and £19.99 per year for additional cards, providing a prepaid card customisable with spending limits and permissions.

GoHenry aims to educate children and teens about budgeting and the importance of money. The app provides a clear overview of all transactions, such as pocket money, weekly savings, spending, and money-earning tasks, helping children understand their expenses and track their earnings and savings. Parents can use the app’s features to monitor and track their child’s spending, receiving real-time notifications when they use their GoHenry kids debit card. Parents also can set spending limits, determining where and how much their children can spend.

Gimi is a money management app designed to teach kids about saving, spending, and budgeting. It enables children to establish savings goals, monitor expenses, and gain insights into financial responsibility.

Starling Kite is a debit card specifically created for children aged 6-16 years, aiming to simplify pocket money, saving, and budgeting. Kids get their own child-friendly version of the Starling app on their phone, allowing them to easily check their balance, view transactions, and receive real-time spending notifications.

How can teens make money?

Here are five ideas for teens to make money:

- Babysitting: Offer your babysitting services to neighbours or family friends. Many parents are in need of responsible and trustworthy teens to look after their children while they are away.

- Gardening: Offer to mow lawns, weed gardens, trim hedges, or do other outdoor jobs for people in your community. You can create flyers or spread the word to find potential clients.

- Pet sitting or dog walking: Many pet owners need someone to care for their furry friends while they are away. Offer pet sitting services, such as feeding, walking, and playing with pets, or simply offer to take dogs for walks.

- Tutoring: If you excel in a particular subject, offer tutoring services to younger students in your school or community. You can help them with homework, studying, or specific subjects where you have expertise.

- Creative crafts and handmade products: If you have artistic skills or enjoy crafting, create and sell handmade products. This could include jewellery, artwork, personalised accessories, or even custom-made greeting cards. Set up a stall at community events, or sell your items to friends and family.

How to make money as a teen online

If you’re a teenager who wants to earn money online, there are some excellent ways to do it. Here are some easy ideas for making money online:

- Freelancing: If you’re good at writing, designing, coding, or managing social media, you can offer your skills to people who need them. Websites like Fiverr, Upwork, and Freelancer can help you find jobs.

- Online surveys and tasks: You can earn money by doing surveys, watching videos, or doing simple online tasks. Websites like Swagbucks, Survey Junkie, and InboxDollars offer these opportunities.

- Selling stuff online: If you have cool things to sell or even some random antiques from your attic, you can start your online store. Platforms like Etsy, eBay, or Gumtree are great for selling crafts, old stuff, or things you no longer use.

- Blogging or vlogging: If you like writing or making videos, you can start a blog or YouTube channel. As your audience grows, you can make money from ads or partnerships with brands. It can take time to grow an audience, so don’t expect to make any money initially.

- Affiliate marketing: Joining affiliate programs allows you to promote products or services on your website, blog, or social media. You earn money when people buy things through your special links.

- Online tutoring: If you’re good at a subject, you can tutor others online. Websites like Tutor.com and Chegg Tutors help connect students with tutors like you.

Just make sure to stay safe online and be careful about scams. Always check if a website is trustworthy and protect your personal information.

Chapter 6:

The cost of raising a child with special needs

Chapter 8:

Will a student loan affect my future?