Warning: Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk.

Payday Loans calculator

Small Personal Loans calculator

What if I miss a repayment?

If you won’t be able to make a payment, call us! On the day of the missed repayment, we’ll send you a text and email to tell you about it. We’ll then try to call you to figure something out.

Unless we’ve come to an agreement, a £10 late fee will be added to your account the day after the missed payment. Interest will continue to accrue at up to the daily capped rate, until you make a repayment or contact us to come to an agreement. Should this continue for a while, the total amount of interest and fees will never exceed the amount you borrowed in the first place. Please call us as soon as you know you’ll be missing a payment, so that we can avoid the £10 late fee.

- Mon – Fri: 9am – 5:30pm

Can I repay my loan early?

Yes! One of the best features of a Cashfloat loan is the early repayment option. Of course, we won’t charge you any extra fee or penalty. You can pay off any amount of your loan as early as you wish and save on interest. Already have a loan you want to pay early? Find out how to do it here.

I paid my loan off early but didn’t save so much money. Why?

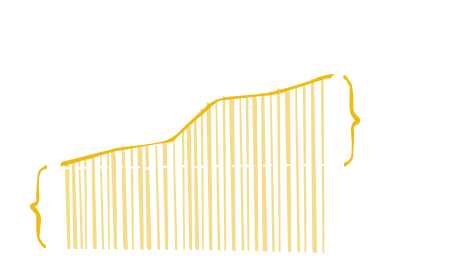

The reason is probably our loans are repaid in instalments. If a non-compounded loan is taken for precisely one period, the interest is linear. So, half the time means half the interest, as can be seen in the following graph:

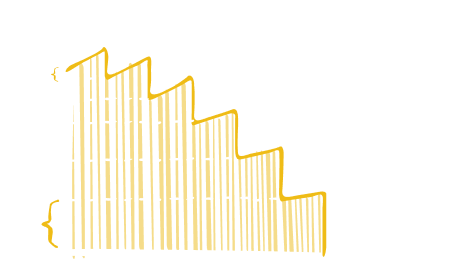

However, for loans with multiple instalments, things get more complicated. In the beginning, most of the payment goes to cover the interest. Only at the end do the payments go towards the principal. The same rule applies to all the loans in the world, from mortgages to car loans.

The interest is calculated over the remaining of the principal. So, in the beginning, the loan accumulates high interest. As the loan advances, you can see that the diagonal is less and less steep. And a more significant part of the payment goes to cover the principal. For this reason, the beginning of the loan is the expensive part. The more instalments there are, the more this phenomenon is noticeable.

A bit about loan calculators

- Loan Calculators This calculator is one in which you put in the starting conditions of the loan, i.e.: The loan sum, the payment frequency (monthly or weekly), the interest rate and any related fees, if any. The calculator allows you to calculate the periodic payment you will have to pay, the total cost of the borrowing (interest), and the total of all fees you will need to pay. Playing with different input data can enable you to see what the most suitable deal is for you. This loan calculator is typically used to calculate online pay day loan repayments. This type of calculator is displayed at the top of this page.

- Reverse Loan Calculators The purpose of a reverse loan calculator is to get different data about the loan, such as the loan amount, payment amount, payments rate. Using this, you can do a reverse calculation of the interest rate and other financial data. The purpose of this loan calculator is to actually allow you to check whether the proposed loan has any errors, if it is fair, and in general, where it stands in relation to other proposals that you might have.

- Mortgage Calculators This is actually a standard loan calculator, but a type that calculates long-term loans with large payment amounts specifically. It is important to note that it is essential to know whether the loan is a compound loan, or a non-compound loan. The math behind these two types of loans is completely different. The calculator must identify the right type of loan, otherwise, we will get false calculations.

Your login area

We wanted to make it as easy as possible for you to save money. When you log in, you’ll see a calculator that will tell you exactly how much money you’ll be saving off the total amount of your loan if you repay any amount now. We just want to make your life easier. Click here for a step by step explanation of the login area.

If you’re looking for a short loan with terms you can understand, you’re in good hands. Here at Cashfloat, we avoid mysterious clauses and complicated terminology, and explain clearly and simply exactly how your loan will work. If you have any questions, contact our customer support team – we’re happy to help! Like what you see? Apply now for a Cashfloat loan.

Borrowing

Borrowing

Repayment

Repayment